U.S. MINT OIL – 2021 CROP SPRING REPORT – MAY 2021

CURRENT CROP CONDITION

In general, North American mint plantings have over-wintered well. Rain and snowfall have been below average but there was sufficient winter moisture to maintain healthy rootstocks.

Irrigation water supplies may be tight, but adequate for mint production in the far west regions. One significant trend which may portend the future, is that the primary irrigation water source for the southern Oregon/northern California region has been shut off completely because of environmental issues. Although this area is not large enough to significantly affect supply, it causes concern for availability of irrigation water in the future.

MARKET CONDITIONS

Peppermint – Overall demand for North American peppermint oil continues to be slow. We see steady demand in the oral care industry and weak demand in the confectionery industry. For a brief period this winter, prices paid to the producer dropped below market price and growers in

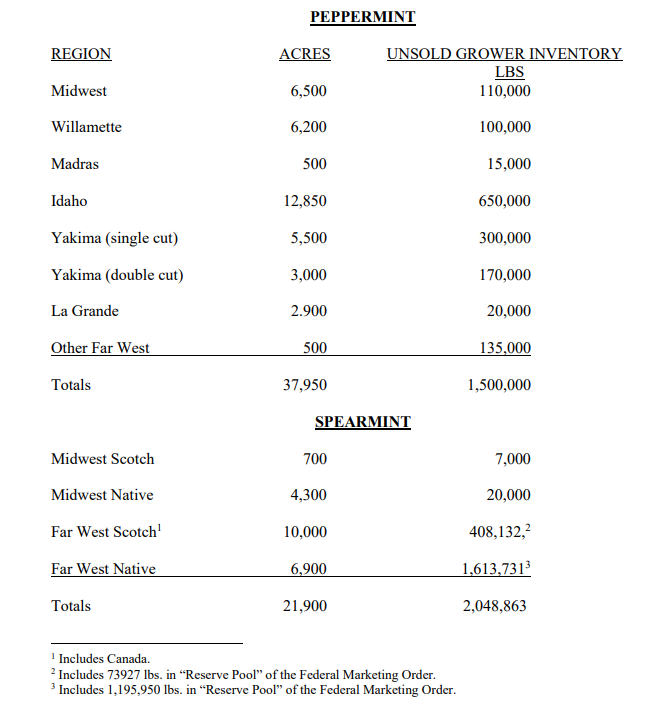

weak financial condition liquidated their stocks. This left unsold inventories in strong financial ownership and prices rebounded some. Less than average quantities of the 2021 crop are pre-sold on a contractual basis and we expect that industry demand will continue to be dull. This may well lead to further reduction of acreage for the 2022 crop and could lead to a tighter supply situation by 2023 crop year. As compared to this date one year ago, peppermint acreage has declined an additional 19%, unsold carryover stocks have increased 89% and market volume demand has declined 25%

Spearmint – As has been the situation for a number of years, the only significant production and supply of natural spearmint oil worldwide is North America. Global demand for spearmint oil continues to be steady. Due to good supply prices have weakened some and growers are responding by slowly reducing acreage. As compared to this date one year ago, acreage in production has declined 11.7%, unsold carryover stocks have declined 2.2% and market volume demand has increased by 3.5%